The blog discuss the process on running the Sweep Program for processing the unaccounted transactions in Oracle Payables R12. When the Account Payables Period is closed there could be the possibility of pending AP transactions which are not accounted for that particular period which are considered as ‘unaccounted transactions in accounting period’ . Due to this the Oracle Payables Period cannot be Closed.

What causes unaccounted transactions ?

Few example which causes unaccounted transactions in Oracle Payables

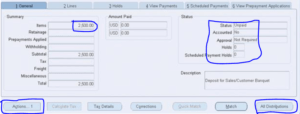

- Oracle Payables Invoices with Holds applied

- Oracle Payables Invoices requires change in Distribution Accounting

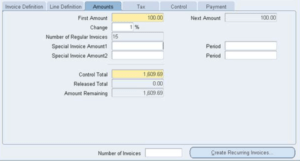

Oracle Payables R12 Unaccounted Transactions Sweep Program transfers unaccounted transactions from one accounting period to another. The Unaccounted Transactions Sweep Program changes dates of unaccounted transactions to the first day of the specified next open period

When the Unaccounted Transactions Sweep Program submitted by user gets completed, it generates the Unaccounted Transactions Sweep Report listing transactions whose accounting transactions date has been changed to next open period

Points to Consider for submitting Unaccounted Transactions Sweep Program

- Oracle recommends to ensure that the Oralce Payables setup allows Payables User to change accounting transaction dates

- Ensure that the given change accounting transaction date is for the Open Period

- Ensure that the transaction is not accounted in the Oracle Payables

- Oracle recommends to submit the Period Close Exceptions Report. Review, for each organization, the Unaccounted Invoices and Unaccounted Payments sections of the report to review the transactions that the program will sweep to the next period

How to submit Unaccounted Transactions Sweep Program ?

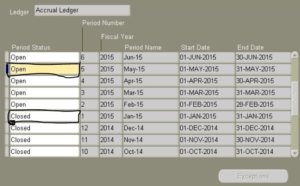

- Navigate to the Control Payables Period Window

- Select the Open Period that need to be closed

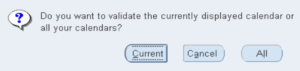

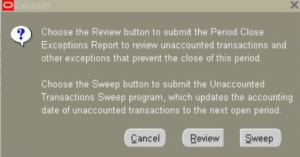

- When updates the Period Status from Open to Closed, System will generate the message that Period cannot be closed due to Exception

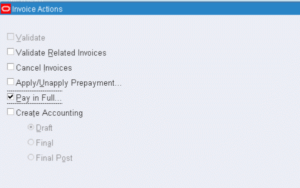

- Click on Exceptions button , Oracle Payables provides the below given options

Review (Submit the Subledger Period Close Exceptions Report for the Current Period that need to be Closed to view the listed exception)

Sweep ( Allows to change the Accounting Transaction Date to Open Period Date)