The blog discuss about the Accounting Rule Configuration in Oracle Account Receivables R12. Accounting Rule in Oracle Receivables allows to create Invoice Revenue Recognition schedule for the invoices to be processed. Accounting rule determines number of periods and revenue percentage to be recorded for each accounting period.

Accounting rules can be configured for the AutoInvoices ( Import Transactions into Receivables) and manually created Invoices in Oracle Receivables R12. Oracle Receivables R12 provides the Revenue Recognition Program which processed all the eligible invoices and generated distribution for the period for which accounting rule is configured. The accounting period with status Open, Future and Not Open are considered for revenue recognition accounting distribution. Invoice with period as Closed creates distribution in the next open, Future, Not Open period

Define Period Type and Accounting Calendar in Oracle EBS R12

Define Accounting Rules in Oracle Receivables

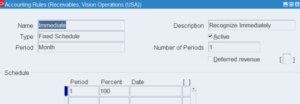

Perform the below given steps for creating receivables accounting rule

- Navigate to Accounting Rule Window

- Enter the Accounting Rule Name

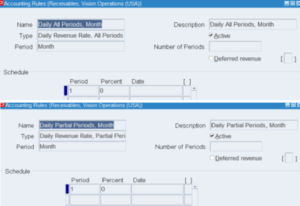

- Enter the Accounting Rule Type from the below given selections

| Accounting Rule Type Name | Accounting Rule Type Description |

| Fixed Schedule | allows to calculate the prorate revenue recognition evenly whenever the accounting rule is being applied on invoice lines for the specific accounting period |

| Variable Schedule | allows to calculate the revenue recognition over number of periods and assign the accounting rule with the values passed through AutoInvoices and manually entered invoices |

| Daily Revenue Rate , All Periods | allows to calculate the daily revenue rate with the précised revenue amount for full and partial period in the schedule |

| Daily Revenue Rate , Partial Periods | allows to calculate the daily revenue rate with the précised revenue amount for partial period in the schedule |

- Enter the Accounting Period and select the Defined Period Type.

- Enter Number of Periods if the Accounting Rule is Fixed Schedule

- Deferred Revenue Checkbox (Select this option if revenue is to be deferred to unearned revenue account)

- Enter % of revenue for Accounting Period ( For Fixed Schedule it should be 100% , For Variable Schedule is not required to be defined)

- If Accounting Rule Type is Fixed Schedule and selected Specific Dates , then enter dates for revenue recognition in accounting period

Deferred Accounting Rule in Oracle EBS R12

Deferred Accounting is required when specific transactions need to be accounted for Unearned Revenue Account. The Deferred accounting Rule can be enabled in the Invoice and Accounting Rule Windows by selecting the Deferred Revenue Checkbox.

The Revenue Recognition Program creates a single distribution per line for Unearned Revenue Account posting using the Revenue Accounting Management (RAM). The Deferred Accounting Rule can be applicable to invoices with the Invoicing Rule as ‘Bill In Advance’ .

If the Deferred Accounting Rule is applicable for single accounting period, then it revenue is recognized in the period for which Revenue Accounting Management (RAM) is specified

If the Deferred Accounting Rule is applicable for multiple accounting period, then it revenue is recognized as per the schedule accounting rule and start date is considered as GL Date retrieved from RAM Wizard. If the GL Date is specified for a Closed Period, then revenue is recognized in the next Open Accounting Period