| Window Name | Navigator Path |

| Account Details | Collections->Account Details |

| Account Overview | Collections->Account Overview |

| Accounting Calendar | Set Up->Financials->Calendars-> Periods |

| Accounting Periods | Accounting->Open/Close Periods |

| Aging | Collections->Aging |

| Alternate Name Receipt Matches | Customers->Alternate Name Matches |

| Adjustment Approval Limits | Set Up->Transactions->Adjustment Limits |

| Aging Buckets | Set Up->Collections->Aging Buckets |

| Aging | Collections->Aging |

| Approve Adjustments | Control->Adjustments->Approve Adjustments |

| Assign Flexfield Security Rules | Set Up->Financials->Flexfields-> Descriptive->Security->Define |

| Assign Key Flexfield Security Rules | Set Up->Financials->Flexfields-> Descriptive->Security->Define |

| Assign Security Rules | Set Up->Financials->Flexfields-> Descriptive->Security->Define |

| AutoCash Rule Sets | Set Up->Receipts->AutoCash Rule Sets |

| AutoInvoice Grouping Rules | Set Up->Transactions->AutoInvoice ->Grouping Rules |

| Automatic Accounting | Set Up->Transactions-> AutoAccounting |

| Automatic Payment Programs | Set Up->Receipts->Receipt Programs |

| Bank Charges | Set Up->Receipts->Bank Charges |

| Banks | Set Up->Receipts->Bank |

| Category Codes | Set Up->Transactions->Item-> Category->Define->Category |

| Category Sets | Set Up->Transactions->Item-> Category Define->Default Sets |

| Clear/Risk Eliminate | Receipts->Clear/Risk Eliminate |

| Collectors | Set Up->Collections->Collectors |

| Completed Requests | Control->Requests->View |

| Concurrent Requests Summary | Control->Concurrent |

| Conversion Rate Types | Set Up->Financials->Currencies-> Rates->Types |

| Copy Transactions | Transactions->Copy |

| Correspondence | Collections->Correspondence |

| Countries and Territories | Set Up->System->Countries |

| Create AutoAdjustments | Control->Adjustments->Create AutoAdjustments |

| Credit Transactions | Transactions->Credit Transactions |

| Cross Validation Rules | Set Up->Financials->Flexfields-> Key-> Rules |

| Currencies | Set Up->Financials->Currencies-> Define |

| Customer Accounts | Collections->Customer Account |

| Customer Calls | Collections->Record A Call |

| Customer Interface | Interfaces->Customer |

| Customer Merge | Customers->Merge |

| Customer Profile Classes | Customers->Customer Profile Classes |

| Customers Quick | Customers->Customer Quick |

| Customers Standard | Customers->Customer Standard |

| Customers Summary | Customers->Customer Summary |

| Daily Rates | Set Up->Financials->Currencies-> Rates->Daily |

| Default Category Sets | Set Up->Transactions->Item-> Category->Define->Sets |

| Define Security Rules | Set Up->Financials->Flexfields-> Descriptive->Security->Define |

| Descriptive Flexfield Segments | Set Up->Financials->Flexfields-> Descriptive->Segments |

| Distribution Sets | Set Up->Receipts->Distribution Sets |

| Document Sequences | Application->Document->Define (use System Administrator responsibility) |

| Dunning History | Collections->Account Details. Choose Dunning History button. |

| Dunning Letter Sets | Set Up->Print->Dunning Letter Sets |

| Dunning Letters | Set Up->Print->Dunning Letters |

| F4 Define Organization | Set Up->System->Organization |

| Freight Carriers | Set Up->System->QuickCodes-> Freight |

| GL Accounts | Set Up->Financials->Combinations |

| Interface: Customer | Interfaces->Customer |

| Interfaces: AutoInvoice | Interfaces->AutoInvoice |

| Inventory Delete Items | Set Up->Transactions->Item->Delete Items |

| Invoice Line Ordering Rules | Set Up->Transactions->AutoInvoice ->Line Ordering |

| Invoicing and Accounting Rules | Set Up->Transactions->Rules |

| Item Status Codes | Set Up->Transactions->Item->Status |

| Item Tax Rate Exceptions | Set Up->Tax->Exceptions |

| Key Flexfield Security Rules | Set Up->Financials->Flexfields->Key ->Security->Define |

| Lockbox Transmission History | Receipts->Lockbox->Transmission History |

| Lockboxes | Set Up->Receipts-> Lockbox->Lockbox |

| Lockbox Transmission Data | Receipts->Lockbox->Maintain Transmission Data |

| Memo Lines | Set Up->Transactions->Memo Lines |

| Open/Close Accounting Periods | Accounting->Open/Close Periods |

| Payment Methods | Set Up->Receipts->Receipt Classes |

| Payment Programs | Set Up->Receipts->Receipt Programs |

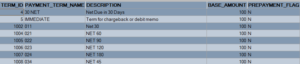

| Payment Terms | Set Up->Transactions->Payment Terms |

| Period Rates | Set Up->Financials->Currencies-> Rates->Period |

| Period Types | Set Up->Financials->Currencies-> Rates->Type |

| Print Accounting Reports | Reports->Accounting |

| Print Dunning | Print->Documents->Dunning |

| Print Invoices | Print->Documents->Invoices |

| Print Statements | Print->Documents->Statements |

| Profile User Values | Control->Profile Options |

| Quick Codes Demand Class | Set Up->System->QuickCodes-> Demand Class |

| Quick Find by Alternate Name | Customers->Quick Find by Alternate Name |

| Receipt Batches Summary | Receipts->Receipts Summary |

| Receipt Batches | Receipts->Batches |

| Receipt Classes | Set Up->Receipts->Receipt Classes |

| Receipt Sources | Set Up->Receipts->Receipt Sources |

| Receipts Summary | Receipts->Receipts Summary |

| Receipts | Receipts->Receipts |

| Receivables Activities | Set Up->Receipts->Receivable Activity |

| Receivables Quick Codes | Set Up->System->QuickCodes-> Receivable |

| Remit-To Addresses | Set Up->Print->Remit To Addresses |

| Remittances Summary | Receipts->Remittances |

| Remittances | Receipts->Remittances |

| Request Sets (User Mode) | Control->Requests->Set |

| Requests Accounting | Reports->Accounting |

| Requests Collection | Reports->Collections |

| Requests Listing | Reports->Listing |

| Requests Other | Reports->Other |

| Requests Submit | Control->Requests->Run |

| Run AutoInvoice | Interfaces->AutoInvoice |

| Run Customer Interface | Interfaces->Customer |

| Run General Ledger Interface | Interfaces->General Ledger |

| Run Revenue Recognition | Control->Accounting->Revenue Recognition |

| Run Tax Rate Interface page | Interfaces->Tax Rate |

| Sales Tax Rates | Set Up->Tax->Sales Tax Rates |

| Salespersons | Set Up->Transactions->Salespersons |

| Scheduler | Collections->Scheduler |

| Segment Values | Set Up->Financials->Flexfields-> Descriptive->Values |

| Set of Books | Set Up->Financials->Books |

| Shorthand Aliases | Set Up->Financials->Flexfields->Key ->Aliases |

| Standard Memo Lines | Set Up->Transactions->Memo Lines |

| Standard Messages | Set Up->Print->Standard Messages |

| Statement Cycles | Set Up->Print->Statement Cycles |

| Submit Lockbox Processing | Interfaces->Lockbox |

| System Options | Set Up->System->System Options |

| Tax Authorities | Set Up->Tax->Authorities |

| Tax Codes and Rates | Set Up->Tax->Codes |

| Tax Exemptions | Set Up->Tax->Exemptions |

| Tax Locations and Rates | Set Up->Tax->Locations |

| Tax Options | Set Up->Tax->GL Tax Assignments |

| Territories | Set Up->Transactions->Territories |

| Transaction Batches Summary | Transactions->Batches Summary |

| Transaction Batches | Transactions->Batches |

| Transaction Overview | Collections->Transaction Overview |

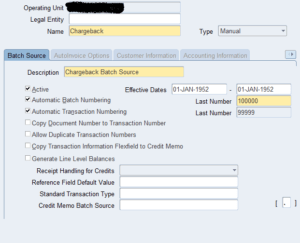

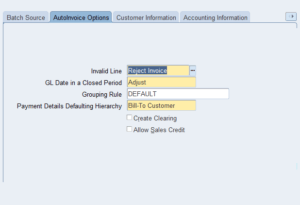

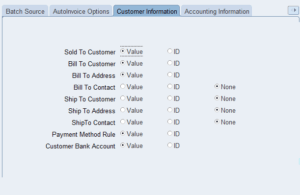

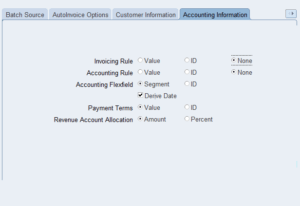

| Transaction Sources | Set Up->Transactions->Sources |

| Transaction Summary | Transactions->Transaction Summary |

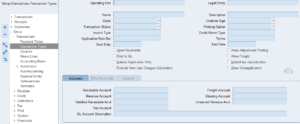

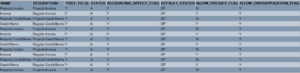

| Transaction Types | Set Up->Transactions->Transaction Types |

| Transactions | Transactions->Transactions |

| Transactions Summary | Transactions->Transactions Summary |

| Transmission Formats | Set Up->Receipts->Lockbox Transmission |

| Units of Measure Classes | Set Up->System->UOM->Class |

| Units of Measure | Set Up->System->UOM->UOM |

| Viewing Requests | Other->Requests->View |