Oracle Account Receivables (AR) defines Payment Terms Setup for the Customers in Oracle Apps R12. Payment terms are used to determine the amount of each installment. Oracle Account Receivables allows to distribute tax and freight charges across all installments, or allocate all freight and tax amounts in the first installment of a split term invoice. Oracle Account Receivables shows all the active payment terms defined in the setup as list of values (LOV) in the Customers, Customer Profile Classes, and Transactions windows.

Responsibility: Receivables Manager

Navigation: Setup > Transactions > Payment Terms

Oracle Account Receivables (AR) provides two predefined payment terms:

- 30 NET: The balance of the transaction is due within 30 days.

- IMMEDIATE: The balance of the transaction is due immediately (i.e. on the transaction date). These payment terms can be user with Chargebacks and Debit memos

Please find below the details for the fields being used in the Payment Terms Setup

Name : Name provided for the Payment Term

Description: provides the purpose for what payment term is being defined

Installment Options: Include tax and freight in first installment

Base Amount : Default value is 100 but can be changed as per requirement.

If the Relative Amount is different than the Base Amount , then Account Receivables uses the below given equation to determine the original amount due for each installment of invoices to which you assign the payment term

Amount Due = Relative Amount/Base Amount * Invoice Amount

If Installment Options Include tax and freight’ as the First Installment field value for a payment term, the base amount and the relative amounts indicate how the original line amounts of the invoices are distributed across different installments

Amount Due = (Relative Amount/Base Amount * Base Line Amount) + Base Freight Amount + Base Tax Amount

Print Lead Days : If transactions assigned to the payment term to be printed before the due date, enter a number of Print Lead Days

Discount Basis: Account Receivables uses this value when calculating discounts for the invoices

- Invoice Amount: Calculate the discount amount based on the sum of the tax, freight charges, and line amounts of your invoices.

- Lines Only: Calculate the discount amount based on only the line amounts of your invoices.

- Lines, Freight Items and Tax: Calculate the discount amount based on the amount of line items, freight, and tax of your invoices, but not freight and charges at the invoice header level.

- Lines and Tax, not Freight Items and Tax: Calculate the discount amount based on the line items and their tax amounts, but not the freight items and their tax lines, of your invoices

Effective Date: Range of Effective Dates for this payment term. If no end date provided, the payment term will be active indefinitely

Receivables uses the following hierarchy to determine the default payment term for your transactions, stopping when one is found:

- Bill-to site, defined at the Site level profile of the customer record

- Customer, defined at the Account level profile of the customer record

- Transaction Type

NOTE: Once a payment term has transactions associated to it, it cannot be updated. A new payment term would need to be created.

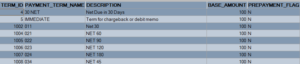

SQL Query to get the defined Payment Terms in Oracle Apps R12:

| SELECT RA.TERM_ID, RA.NAME PAYMENT_TERM_NAME , RA.DESCRIPTION DESCRIPTION , RA.BASE_AMOUNT, RA.PREPAYMENT_FLAG, RA.CYCLE_NAME FROM APPS.RA_TERMS RA |